Leasing solutions

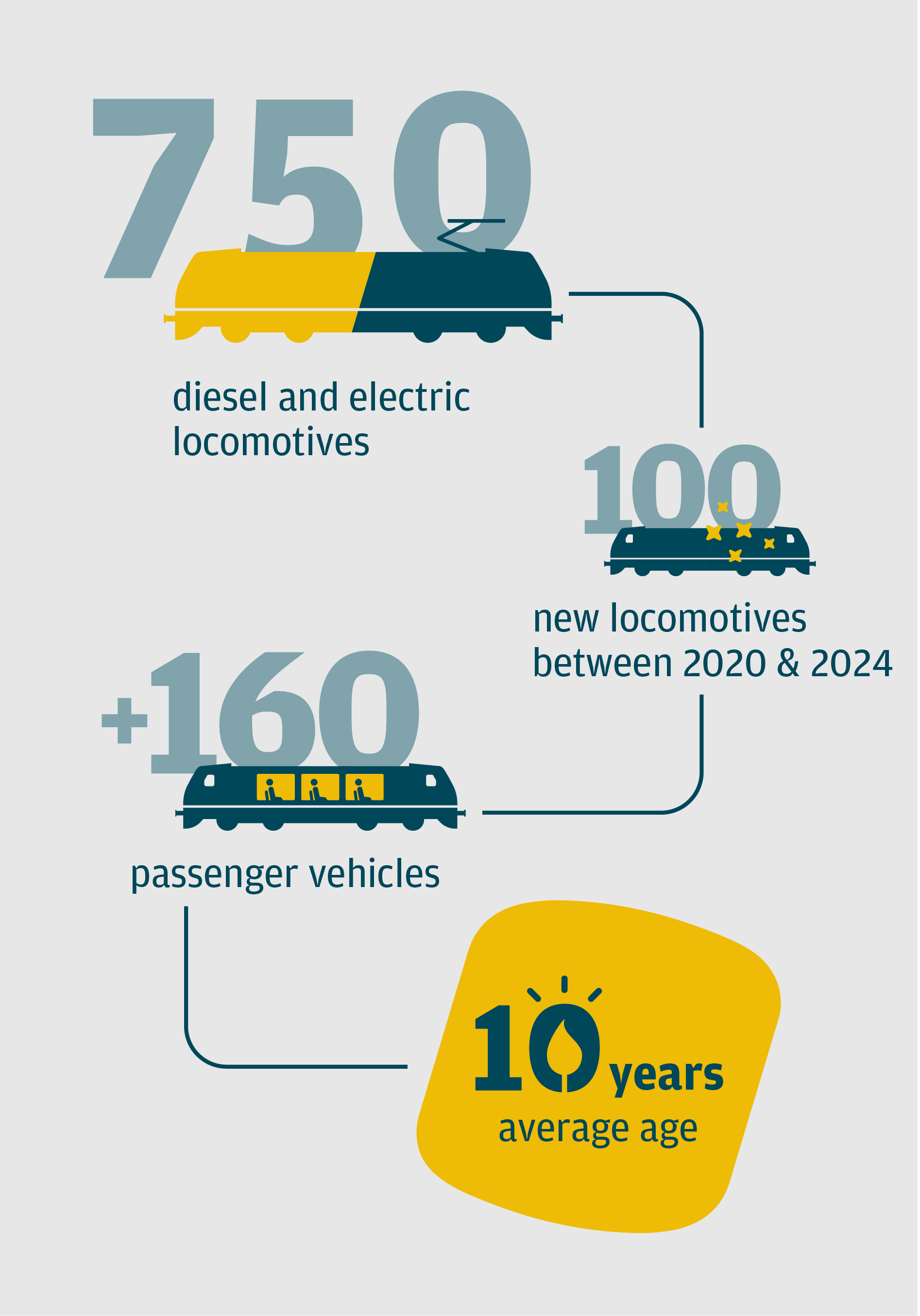

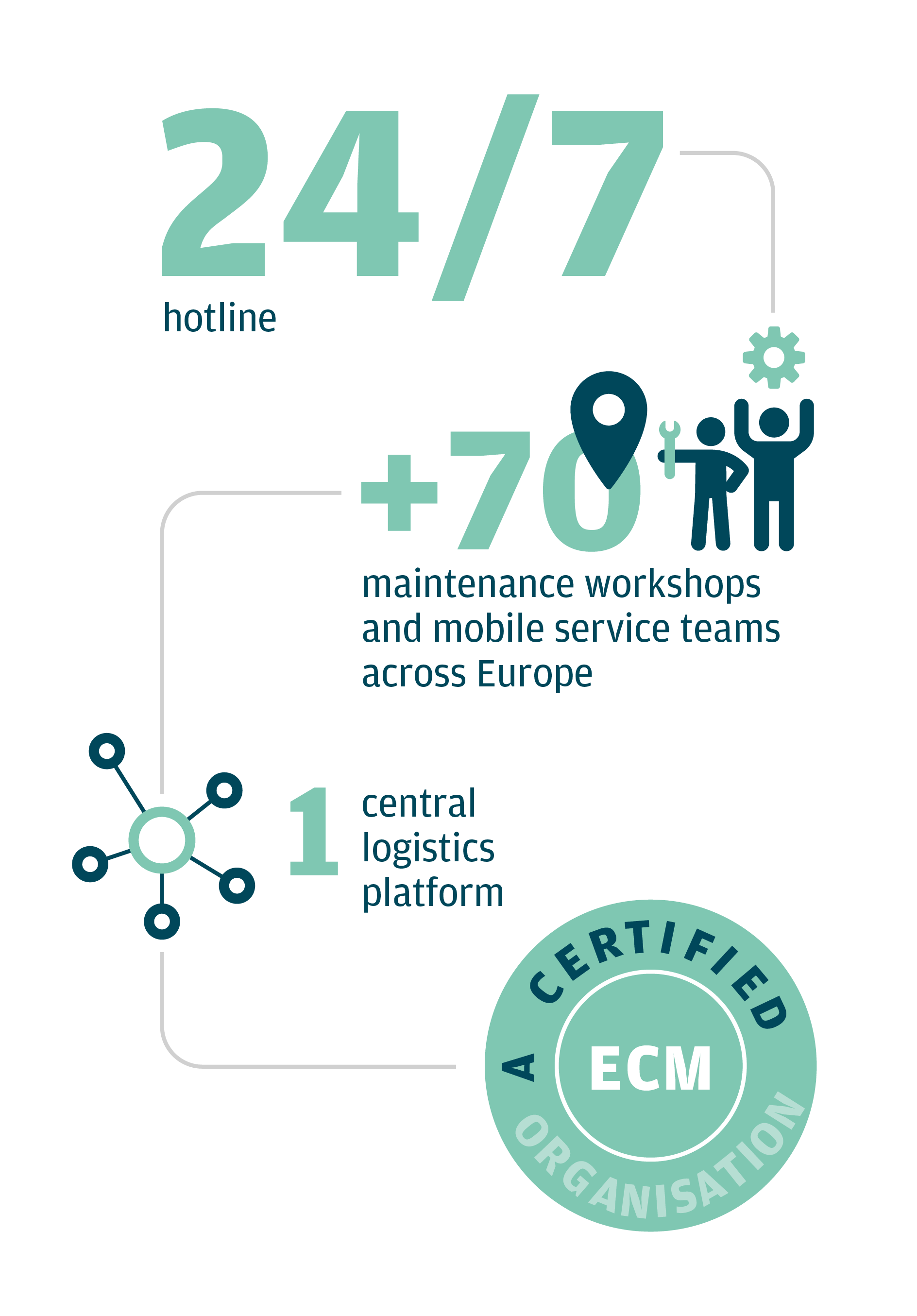

Modular and tailor-made for you, together we can build the solution that best meets your needs and fleet strategy

En cliquant sur « continuer » vous accédez à un autre site

Continuer Rester sur le site Akiem